Dash Home Loans’ First-Time Home Buyer’s Guide

For first-time home buyers, navigating home financing can be… a lot to handle. Suddenly, you have to know things like “interest rates” and “escrow.”

It’s natural to doubt whether or not you can do this. But you can do this, because you’ve got us! It’s our personal belief that everyone deserves to be a homeowner.

We created this comprehensive guide just for newbies like you. It will walk you through each step of the home buying journey, defining key terms along the way.

After Reading Our First-Time Home Buyer Guide:

- You will know what “interest rates” and “escrow” are

- You will understand how buying a home works

- You will finally feel confident enough to purchase your first home

Just how comprehensive is this guide? Very. That’s why we suggest reading a few sections each day. You can also download and print a PDF version to read at your own pace.

Want a PDF version of the guide? Complete the form below.

Are You Ready to Buy a House?

Key Takeaways

- Determine if you are ready for the financial responsibility of owning a home

- Think honestly about if the home you can afford meets your needs

Before you dive headfirst into a 30-year mortgage, weigh the pros and cons of owning.

Will The House That I Can Afford Meet My Needs?

A mortgage isn’t something you should rush into. You need to consider all factors like,

- Can you afford to buy a home in your desired neighborhood?

- Are you able to purchase a home that’s big enough to accommodate your family?

- Will this move shorten your commute to work?

- Will your kids continue attending their desired school?

If you keep answering “no,” this might not be the time to buy. Renting may be the best decision for your lifestyle, at least for now. If you answer “yes,” however, now might be the time for you to make a move.

Can I Afford New Homeownership Costs?

Homeownership can have very different costs than renting. Instead of just cutting a check to your landlord each month, you’ll need to think about:

- Making repairs

- Paying for upkeep

- Paying taxes

- Covering insurance costs

- Covering all of the utility costs

However, there are financial advantages to having homeownership costs.

- Rent isn’t a controlled cost and can go up at any time. A fixed-rate mortgage, however, remains constant over the lifetime of the loan.

- Rent payments don’t bring you equity. A mortgage payment, however, brings you closer to owning a home giving you equity that you can borrow from in the future.

Am I Financially Stable Enough to Buy?

To set yourself up for success, you want to make sure you can financially handle the responsibilities of homeownership.

- Do you have a secure job?

- Will your income stay the same or increase over the coming months and years?

- Does your co-borrower, if you have one, have a secure job too?

- Will you still be able to cover large upcoming expenses after purchasing a home?

You can always wait and spend the next few years squirreling away money.

Will The Value of The Home Increase or Decrease Over Time?

In some cases, the value of the home you hope to buy may be projected to decrease.

There are lots of factors that can impact the value of your home – some of which are in your control:

- Location and neighborhood

- The current state of the housing market

- The state of the economy and current interest rates

- Prices of comparable homes (aka neighborhood comps)

- The size of your home

- The age and condition of your home

- What upgrades or updates you’ve made to the home

Together, these factors can impact your home value and ability to sell the home later.

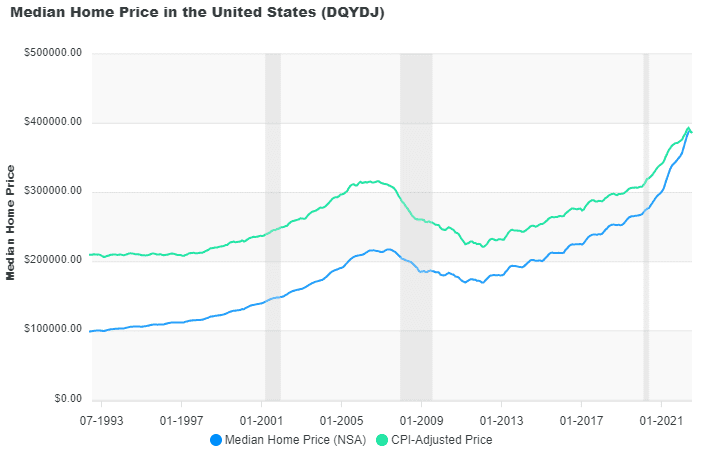

As you can see in the chart below, provided by DQYDJ, the median home price in the U.S. has stayed relatively positive.

While there is no fail-proof method to predicting whether your dream home will appreciate in value, there are some things you can look for.

- Does the property have value by itself? Real estate value has a large impact on home value. Land appreciates in value more consistently than the buildings on it. That’s why waterfront properties, for example, tend to appreciate in value.

- Is the local housing market doing well? Even when home values are down at a national scale, some cities still offer home value gains, especially cities experiencing new growth and revitalization.

- Can you complete mild upgrades to the home? New construction homes tend to have all the bells and whistles, leaving very little to upgrade. This makes it difficult to find upgrades that will improve the home’s value.

Calculating What You Can Afford & Homeownership Expenses

Key Takeaways

- Home-related costs shouldn’t exceed 28% of your income

- Be aware of the expenses you’ll incur before, during, and after buying a house

Before you start falling in love with homes on the market, you need to determine just how much house you can afford.

Here’s how to calculate what you can afford:

- Determine what your household income is

- Calculate all of your current monthly payments (e.g. credit cards, loans, food costs) and subtract the total from your income

- Determine how much you will need to save each month for other needs and subtract that too

However much you have left over is a ballpark of what you can afford to pay each month on a mortgage.

You may also want to consider using the 28% rule. This common-sense adage states that home-related costs should never exceed 28% of your gross (pre-tax) income.

Homeownership Expenses

We won’t sugar-coat it: Buying a house can be costly. There are expenses every step of the way and they vary based on your location and the vendors you hire.

The key is to be aware of the costs before, during, and after you sign on the dotted line.

Expenses Before You Buy

Down Payment

These are the funds you’ll pay toward the purchase price of your home (unless you opt for a zero-down loan option). Depending on the lender, your down payment will range from 3 to 20% of the purchase price of the home.

Credit Report

You’ll pay a one-time fee for the lender to pull a copy of your credit report. This helps them make a decision about whether or not to lend to you. This may be a part of your closing cost fees. It ranges from $10 to $100.

Home Appraisal

A home appraisal is a requirement for nearly all loans. During a home appraisal, a professional provides a full inspection to determine the value of the home based on features, size, location, and the value of recently sold homes in the area. It costs between $450 and $750.

Home Inspection

You pay for the home inspection, and it’s your way of ensuring that the home is safe and secure. The home inspection can also tell you about potential upgrades and repairs you’ll need to make in the coming months and years. It costs between $200 and $1,000.

Pest Inspection

Your lender needs to ensure the home is safe from pests, especially termites. Having a professional pest inspector look at the home provides peace of mind. It costs around $100.

Survey

A survey helps you understand where the property boundaries are. This one-time fee is paid at the time of purchase and costs around $400.

Expenses During the Home Buying Process

Origination Fees

This is a one-time fee paid to cover the costs of processing the loan and any associated administrative costs. It generally costs 0.5 to 2% of the loan amount.

Title Insurance

Title insurance is sometimes included in closing costs. Otherwise, it costs around $500.

Closing Costs

Closing costs are generally between 2 and 6% of the home’s purchase price. Closing costs is a more general term that encompasses all of the fees you have to cover at closing, including:

- Appraisal fees

- Survey fees

- Title insurance

- Attorney fees

- Settlement fees

Expenses After You Buy

Moving Costs

Moving costs will depend on the size of your home as well as the distance you’re moving.

Escrow Fees

Escrow fees may be a part of your closing costs. This is an administrative fee for opening and managing an account to hold escrow in.

Repair Fees

The only way to know the cost of repair fees is to hire a professional to complete an inspection.

Property Taxes

Your local taxing authority may charge property tax. Check with your county or city office to learn how much to expect.

Private Mortgage Insurance

This is a monthly payment associated with your loan if you purchased a home with less than 20% down. It helps provide a level of security to the lender, should you default. PMI is normally 0.58 to 1.86% of the original loan amount.

Homeowners Insurance

This is an ongoing monthly payment that covers property and liability insurance. It is often required by your lender. The average homeowner insurance cost is $1,383 per year.

HOA Dues

If you buy property in an area with a homeowners association, you may be expected to pay regular dues. Most are monthly costs, and they vary considerably from one location to the next.

Utilities

These are monthly costs you’ll pay each month for expenses like electricity, gas, water, and sewer. Expect to pay between $100 and $500 a month.

Maintenance and Repairs

These are ongoing costs associated with the routine upkeep of your home. Experts suggest you set aside 1% of the total purchase price of your home for yearly maintenance. So, a $250,000 home would require that you save $2,500 annually.

Lawn Care

You may need to pay ongoing costs to maintain your lawn and exterior of the home. Estimate $100 or more per month.

Understanding Credit Scores

Key Takeaways

- A higher credit score can help you secure a larger loan and lower interest

- You don’t need a perfect credit score to buy a house

- You can (and should) work on improving your credit score

- You can get a free copy of your credit report online

It’s time to pay attention because credit scores are VERY important in the home buying process.

A credit score is a numerical representation of your creditworthiness. This figure is generated by credit bureaus who manage your payment history and debt usage.

Your mortgage lender evaluates your credit score to understand the risk associated with lending you money.

A higher credit score means you are more likely to secure a loan. It may also help you qualify for a lower interest rate.

What Credit Score Is Needed To Buy a Home?

The short answer? It depends.

While 786 is the median credit score for borrowers taking out home loans, you can get qualified for a mortgage with less-than-perfect credit.

Though specific credit requirements will depend on the lender you choose, here are some general guidelines:

| Type of Loan | Minimum Credit Score |

|---|---|

| Conventional | 620 |

| FHA | 580 |

| VA | No requirement, but generally low- to mid-600s |

| USDA | No requirement, but generally 640 |

Recommended Reading

How to Buy a Home With Bad Credit

How to Get a Copy of Your Credit Score

Start with a free copy of your credit report. That’s right, free. You have the legal right to one free copy each year from each of the three main credit bureaus, TransUnion, Equifax, and Experian.

You can request and review your free credit report by visiting AnnualCreditReport.com.

What Impacts a Credit Score?

Credit bureaus gather information on your credit usage and how you manage credit to develop this score. Some of the factors that impact it include:

- Making payments on time

- How much debt you have

- How close you are to maxing out your credit

- The types of debts you have (such as secured loans and unsecured loans)

- How long you’ve had a credit history

- How many loans you’ve applied for

How to Improve Your Credit Score

Improving your credit score is totally doable. However, it does take some time and effort.

If you want to work on your credit score, you must:

- Make payments on time every month. Auto payments can help.

- Keep the amount of debt you have as low as possible. Aim for under 30% of your available credit.

- Settle any judgments made against you.

- Use credit, but try to pay off balances in full.

- Avoid racking up multiple credit cards or loans at one time.

How Much Can You Borrow for a Home Loan: Pre-Qualification & Pre-Approval

Key Takeaways

- Pre-qualification isn’t a guarantee of the loan; it’s an estimate of what you will likely qualify for

- You need a pre-approval letter before putting in offers; this letter proves you have access to a loan to make an offer

You’ve calculated how much you can afford for a monthly mortgage. Now, how much can you borrow from a mortgage lender, bank, or credit union?

To answer this question, you’ll need to get pre-qualified.

What Is Pre-Qualification?

Though it sounds stressful, pre-qualification is quick and easy – in most cases, it takes less than a day.

During the pre-qualification process, you’ll provide your lender with some basic information like your income, monthly expenses, and credit score. They’ll use this information to offer a general idea of how much money you’re eligible to borrow.

Pre-qualification isn’t a guarantee of the loan. It simply gives you an idea of the loan amount you’ll likely qualify for.

You can use this information to narrow your home search to houses in your price range.

What Is Pre-Approval?

Step two is pre-approval.

During the pre-approval process, your lender will provide a more detailed evaluation of the mortgage for which you’ve qualified, including an estimate of the interest rate you’ll be charged. This process is more involved and time-consuming – often taking five to 10 days.

During the pre-approval process, your lender will review:

- The last two years of tax returns

- Paycheck stubs or proof of income

- Bank statements showing available savings

- Your personal identification

- Secondary identification, such as a utility bill or credit card

- Investment account statements to show proof of savings for down payments

- Credit card statements

- Loan statements for other accounts you own

All of this information allows the lender to know just how likely you are to make payments on time and how easily you can afford the loan.

Once you’re approved, your lender will draft a pre-approval letter. You definitely need a pre-approval letter before you start putting in offers on listings. This document shows sellers that you’re serious about buying the home and have sufficient moolah to back up your offer.

RECOMMENDED READING

What’s the Difference Between Pre-Qualified and Pre-Approved?

Financing Your First Home: Your Mortgage, Interest & Down Payment

Key Takeaways

- A mortgage is a loan used to buy a home; homeowners pay off their mortgage each month over the span of 10, 15, or 30 years

- Interest is the cost you pay your lender to borrow money

- While you don’t have to put down a large down payment, there are advantages

Getting approved for a mortgage can feel nerve-wracking. But there’s no need to worry.

When you partner with Dash Homes Loans, our Mortgage Coaches will walk you through each and every step of the financing process.

To give you a head start, we’ve included a little crash course on home financing below. You can also dive into our Guide to Home Financing.

What Is a Mortgage?

Let’s start with the basics.

A mortgage is a loan used to buy a home or another piece of real estate. As a borrower, you agree to pay back the principal plus interest over time.

Typically, homeowners make monthly mortgage payments for 10, 15, or 30 years. The longer the loan term is, the lower your monthly payment is. However, that also means you’ll be paying more in interest.

What Is Interest?

Interest is the cost of borrowing money and is expressed as an annual percentage rate (APR).

The interest rate associated with your loan will depend on many different factors like current market conditions, loan amount, and creditworthiness.

An interest rate that’s even slightly higher can mean paying thousands of extra dollars over the course of your loan. That’s why it’s so important to lock in a low rate.

Fixed vs. Adjustable Rates

Mortgages can either come with fixed or adjustable interest rates.

With a fixed-rate mortgage, the APR is static for the lifetime of the loan. That ensures monthly payments are always consistent.

Adjustable-rate loans may have a lower initial rate, but those rates can rise over time. Though unpredictable, adjustable-rate mortgages are perfect for homeowners who plan on paying off their loan early.

What Is a Down Payment?

A down payment is your initial payment toward the purchase price of the home.

How much money you put down on a home depends on your lender, loan type, and creditworthiness.

While USDA and VA loans can be secured with no money down, FHA loans typically require 3.5% down.

For borrowers with credit scores less than 580, a down payment of 10% is expected.

Comparatively, conventional loans require as little as 3% down. However, if you put less than 20% down, you’ll be expected to pay PMI.

(Forgot what PMI is already? We got you. PMI stands for private mortgage insurance that you pay if you purchase a home with less than 20% down.)

Why Put More Money Down?

Though no-money-down lending options may seem attractive, a larger down payment can be advantageous.

Benefits of putting more money down include:

- A lower monthly mortgage payment

- It can help you stand out in a seller’s market

- You may be able to bypass PMI

- You may be offered a lower interest rate

Down Payment Assistance Programs

But what if you don’t have the cash reserves for a down payment? No problem.

Many states offer down payment assistance programs. These programs make homeownership a reality for low-income buyers.

Down payment assistance comes in many forms, from grants to zero-interest loans.

At Dash, our Mortgage Coaches will make sure to explore any and all down payment assistance programs that you might qualify for.

Mortgage Lenders: How to Choose & Compare Offers

Key Takeaways

- When comparing mortgage lenders, narrow your list down to three and compare offers

- Take your time evaluating each lender; you want to work with someone you can trust

Mortgage lenders are banks, credit unions, and other financial institutions or organizations that provide access to loans.

Dash Home Loans is an example of a mortgage lender.

The lender you pick can mean the difference between getting stuck with unfavorable loan terms (think: high-interest rates) and finding a home loan that works for your budget.

Before You Settle on A Lender, Ask These Questions

How long do you expect the financing process to take?

The mortgage process itself – from application to closing – normally takes between 30 and 60 days. At Dash Home Loans, we have simplified our home lending process to minimize stress and wait times.

Who will be my primary contact during this process? How will we keep in touch?

Loan officers are notorious for offering subpar customer service. But at Dash Home Loans, we match every customer up with a Mortgage Coach who can offer five-star support.

Do you offer a closing guarantee?

If you don’t close as expected, you could be out thousands of dollars in inspections, due diligence money, and appraisals. To minimize this risk, some lenders (think: Dash Home Loans) offer a closing guarantee.

Comparing Mortgage Loan Offers

After learning more about different mortgage lenders and their home financing processes, narrow your list down to three. Then, compare offers made by each lender.

Here’s what you’ll want to evaluate:

- Interest Rate: Since a lower interest rate means a lower monthly payment, you’ll want to lock in the best APR possible.

- Fees: Ask about all the fees associated with mortgage financing – from application fees to underwriting costs.

- Down Payment: What are the down payment expectations? Do you have the cash reserves to meet these expectations?

- Mortgage Insurance: If you put less than 20% down, will you be expected to pay PMI?

Home Loans Available to First-Time Home Buyers

Key Takeaways

- First-time home buyers have access to grants or programs that can help reduce interest rates

- There are many loan options to choose from; a Dash Mortgage Coach can help you find the best one

First-time home buyers are, obviously, individuals who have never purchased a home before. However, you may also qualify as a first-time home buyer if you haven’t owned or co-owned a home in the past three years.

While being a first-time home buyer can be nerve-wracking, being new to the real estate game has two advantages:

- You may be eligible for first-time home buyer grants. Specialized lenders offer these programs based on the state you’re located in. They can help reduce interest rates and help you borrow money for your down payment.

- Lenders may offer more relaxed qualification requirements, like a lower down payment or credit score standard.

Types of Home Loans for First-Time Home Buyers

First-time home buyer loans are widely available in several forms. Here are a few types of mortgages to consider:

Conventional Loans

These loans have moderate interest rates and are most common for borrowers. Lenders typically require a credit score of 620 or higher and a down payment of at least 3%. However, PMI is needed for less than 20% down.

FHA Loans

Since these are backed by the federal government, they have lower credit score and down payment requirements. A first-time home buyer with a credit score of 580 can put down as little as 3.5%.

VA Loans

These zero-down loans are available to eligible individuals who have served in the U.S. Armed Forces. Since VA mortgages are backed by the federal government, they have lower credit score requirements and low- to mid-range interest rates.

USDA Loans

USDA loans are a no-money-down option for low-income borrowers looking to buy in rural areas. They have lower interest rates.

Reasons to Hire a Real Estate Agent for Your First Home Purchase

When you’re ready to start looking at properties, it’s time to hire a real estate agent. These are licensed, experienced professionals who have the sole goal of helping you find your dream home.

A real estate agent that works with home buyers is called a buyer’s agent. Your buyer’s agent works for you and only you, acting in your best interest. (Side note: Homeowners selling their homes also work with a realtor known as a listing agent.)

The best thing about working with a buyer’s agent? The home seller pays the real estate agent’s commission.

Other advantages of working with a real estate agent include:

- Your agent can help you with all aspects of paperwork, from understanding and completing documents to ensuring your legal rights are protected.

- Your agent negotiates for you. Once you find a home, they work with the seller’s agent to negotiate the best terms possible.

- Your agent knows what to look for in a home and can identify concerns before you make an offer.

What To Expect From a Buyer’s Agent

A buyer’s agent makes the house hunting process easier by:

- Finding Listings: Your agent will talk to you about your needs and budget, gathering insight into your desired features, space, and location. Then they get to work, finding and recommending listings.

- Showing Properties: Your agent schedules showings of available properties. They will also research available properties to uncover any problems or issues, giving you all the facts needed to make a decision.

- Making an Offer: Once you find your dream home, your agent will advise you on how to make a legally binding offer.

- Negotiating the Offer: Once the offer is in the hands of the seller, your agent works with the seller’s agent to negotiate the offer. The goal here is to protect your rights and secure a fair price.

- Provide Resources: Real estate agents can also connect you with other professionals like movers, attorneys, appraisers, and home inspectors.

What To Look For in a Real Estate Agent

Before committing to a real estate agent, ask friends and family to recommend prospective realtors. Then, look up their websites and online profiles, reading about their experience and expertise.

It’s a good idea to meet with at least three real estate agents before you decide who to work with.

Consider interviewing each agent, asking questions like:

- How long have you been an agent?

- How many homes do you help buyers purchase each year?

- How well do you know this area?

- Have you helped buyers find homes in my price range?

- How many clients do you have right now?

- How does your commission work?

Remember: Your real estate will be negotiating on your behalf, so you want to find someone you can trust.

Types of Home Sales

Key Takeaways

- There are different ways to sell a home, each offering a different buying experience

As you start looking at homes on the market, also consider how they are being sold. There are various strategies for home sellers to list their property.

However, how they are being sold can play a role in the type of experience you have.

Standard Home Sales

A standard sale is the most common option. A person lists their home on the real estate market and aims to get the highest price possible.

The homeowner handles the entire process, including negotiating the sale, often with the help of their real estate agent.

Sometimes, the home is sold on contingency. That means the home is being sold based on a certain outcome, such as the seller closing on the sale of their own home.

Bank Owned Sales

It is not uncommon for banks to list homes for sale. These are often foreclosed properties.

The bank owns the home and is selling it, sometimes at a fraction of the overall market price.

However, not all bank-owned homes are a good deal – you have to know the market to determine if the value is right.

Keep in mind that most bank-owned homes are sold “as is,” which means that the bank isn’t willing to do any renovation work.

Also, you may not be able to access the full history of the home, including any repairs that have been done.

Short Sale Sales

Short sales occur when a seller is hoping to get out from under a mortgage quickly. They ask the bank to accept an offer on the home for less than what they owe on the loan.

The bank may agree to this if they believe the property cannot be sold at a higher rate or that the homeowner may default on the loan. This could create a good deal for some home buyers. However, the process can be time-consuming.

What to Consider When Searching for Your First Home

Key Takeaways

- Carefully evaluate homes that have been on the market for a long time

- Don’t get hung up on wallpaper and carpets, those can be updated. Look at the bones and structure of the house

When searching for your first home, it helps to keep these three factors in the back of your mind.

1: Price

Once you are pre-approved for a loan, you know what you can afford to buy. But you don’t have to spend the full amount that you’ve been approved for. Some home buyers find lower-priced homes, using their remaining budget for renovations.

2: Size

Think about your current square footage needs, but also how those needs will change.

- Do you want to have children?

- Do you need space for an aging parent?

- Do you want to build a home gym or office?

3: Location

It’s not just about the city, but also the neighborhood. Work with your real estate agent to get a feel for the community as a whole to make sure you’d enjoy living there.

Learn about local restaurants, grocery stores, schools, parks, and greenways. You may even want to get out of your car to experience the area on foot. Your location can have a big impact on your quality of life.

What To Look for When Viewing a Property

Your agent has found the perfect home for you and you’re excited to see it.

Is it too good to be true?

The only way to know is to look at the bones of the house:

- Floors: Type, condition, and whether they need to be cleaned or replaced.

- Cracks: Look at the walls, ceiling, and foundation of the home, both inside and out.

- Leaks: Look for stains on the ceiling or floor. You may also look for evidence of moisture in the basement.

- Windows: The condition, style, and cleanliness are factors here. Make sure they close fully and aren’t drafty.

- Roof: Step away from the home to see all angles of the roof. Look for discoloration, missing shingles, and mold. Eventually, you’ll want to hire a professional to conduct an inspection.

- Trees: Are the trees and shrubs in good condition? Are they causing cracks in the foundation, sidewalks, or driveway?

- Electrical and Plumbing: Though you’ll have a formal inspection later, make sure the lights and faucets turn on. You may even flush the toilet.

Remember: Dated floral wallpaper or carpet in the bathrooms can be updated! Don’t let the home’s decor sway your final decision.

Your real estate agent should also check the home’s ownership history. If the property has been on and off the market numerous times, it may have some problems that aren’t fully understood or disclosed.

Putting in an Offer: Closing Costs, Home Inspection, Earnest & Insurance

Key Takeaways

- A low offer can work for homes that have been on the market for a while, but it likely won’t work for homes in a desirable market

- You may be able to negotiate closing costs, requesting that the seller cover them, but this is less likely in a competitive market

- Home inspections are very important; if the home inspector notices something wrong with the home, the buyer can negotiate and ask the seller to cover the repair costs. Or the buyer can walk away from the deal

- Earnest money is a “good faith” deposit that shows the buyer you’re all in; to avoid losing your earnest deposit, scan your contract for specific contingencies

You’ve found your dream home! (Go ahead, jump for joy. We won’t judge.) Now, you need to put an offer in.

The next question is this: Do you offer more or less than the asking price?

While you want to offer a competitive bid, you also don’t want to overpay for the home.

Lots of factors play into your offer amount. Luckily, your real estate agent can help you determine an appropriate offer amount.

A low offer might be right if:

- You’re operating in a buyer’s market where sellers are more likely to accept your offer.

- The home has been sitting on the market for a while.

- The listing price has already been reduced.

Offering the asking price might be right if:

- The listing price is fair and is similar to other comparable homes.

- The listing is in a desirable market and was recently put on the market.

A high offer might be right if:

- You’re operating in a seller’s market and competition is hot for homes in the area.

- There’s a lot of interest in the home.

- You must have the house because it’s perfect for you in every way.

In addition to price, there are other factors to consider as well. These include:

- Setting a timeline for a response from the seller

- Listing any contingencies you have

- Putting in stipulations for a home inspection

Work with your agent carefully on this, and be sure you are aware of all terms. Terms include when you’ll move out, what type of property (if any) is being left behind, and any details about closing costs.

Negotiating Closing Costs

When purchasing a home, you may be able to negotiate closing costs.

Closing costs are fees charged by the lender and other vendors. These fees typically range from 2 to 5% of the home’s sales price and include expenses like:

- Origination fees

- Fees for appraisals and surveys

- Title and homeowners insurance

- Attorney fees

- Property tax (typically six months of advance tax is paid at closing)

Who Pays Closing Costs?

You may be able to ask the seller to contribute to the closing costs. You could do this if you know your offer is solid or if the seller needs to sell lickety-split.

Another option is to ask the seller to lower the asking price so that you can pay the closing costs.

However, if you are in a competitive market, think again. The seller may disregard this request and move on to another buyer who’s willing to pay all closing costs. Work with your agent to determine if negotiating closing costs is appropriate.

Home Inspection

After you put in an offer, you’ll need to schedule a home inspection. This is a critical step.

During a home inspection, a licensed inspector will review the home, looking for obvious signs of damage or repairs.

If a major repair is detected, the home buyers can renegotiate their offer to cover the cost of the repair. Or, the home buyers can ask that the sellers fix the damage.

A home inspector will review the:

- Heating system

- Central air conditioning system

- Interior plumbing and electrical systems

- Roof and rain gutters

- Attic, including visible insulation

- Walls

- Ceilings

- Floors

- Windows and doors

- Foundation

- Basement

- Structural components

What If The Inspection Uncovers Something Wrong With the Home?

If the home inspector notices something wrong with a specific part of the home, they may recommend you call in a specialist. For example, you may need to hire a plumber to look at faulty pipes and evaluate repair costs.

What if an unexpected issue – a termite infestation, for example – is found during the inspection?

You, as the buyer, have the right to walk away from the deal.

Home Inspections and VA/FHA Loans

If you’re purchasing a home with a VA or FHA loan, you may face very stringent inspection standards.

These lenders want to ensure the home is in good condition, worth the price, and safe. If serious issues are found during the inspection, the seller will need to make repairs before closing.

Earnest Money

Earnest money, also known as a good faith deposit, is a down deposit that home buyers make to show intent to purchase.

When the buyer and seller enter a contract together, the home gets taken off the market. If the deal doesn’t go through, the seller must relist the property. This wastes valuable time.

Earnest money provides the seller with compensation, should a buyer back out of the deal through no fault of the seller.

If the deal closes as planned, the earnest money is applied to the down payment. If the buyer backs out of the deal, they may lose the money.

Earnest Money Contingencies

Within the purchase agreement, you’ll find contingencies that must be met to finalize the sale of the home.

Contingencies protect both the buyer and seller, so read them carefully to understand whether you lose your earnest money in various situations.

- Home Inspection Contingency: This allows the buyer to back out of a deal without losing earnest money if a home inspection reveals serious damage.

- Appraisal Contingency: If the home appraises for less than the listing price, the buyer can walk away from the deal without losing earnest money.

- Financing Contingency: If a buyer doesn’t get approved by a lender, a financing contingency can help them get their earnest money back.

Homeowners Insurance

Before you can sign the contract with your lender, you must have a homeowners policy. This policy must meet coverage requirements set by the lender.

It may be a good idea for your home insurance agent to visit the home to provide an inspection and make policy recommendations.

Fortunately, you can always increase your policy coverage at a later date.

Finalize Your Home Loan & Close on a House

Key Takeaways

- Your lender may re-pull your credit so DO NOT buy any big purchases while closing on a home; this can negatively impact your credit and stall your approval

- Once the closing documents are signed, the home is yours!

With the help of your mortgage lender, you can begin to finalize your home loan. During this step, loan underwriters will conduct another review of your information, ensuring all details are in order before they agree to the loan fully.

At this point, the lender may re-pull your credit, check that you’re still employed, or ask for additional documents. However, this is less common if you’ve already gone through the full pre-approval process.

Very important: This is NOT the time to make big purchases. Buying a new car or taking out a personal loan can affect your credit score, impacting whether or not your loan is finalized. Failing to make payments could also affect mortgage approval.

Closing on Your House

Once the underwriters agree to move your loan forward, the final step is to close on your home.

During closing, you’ll meet with legal representatives to sign documents making the home purchase official.

It’s a good idea to allow the closing agent to read through the entire mortgage document so that you fully understand the loan terms.

If you have any questions, ask for an explanation. It’s their goal to ensure you fully understand the terms you’re agreeing to.

You’ll see a breakdown of all costs during this process. This will include details about when your first payment is due. You’ll also be authorizing payment to the seller for the home at this time.

The closing process completes the home sale. That means you’re officially a homeowner. Congratulations!

First-Time Home Buyer FAQs

Am I ready to buy a home?

Only you can answer that question. Whether or not you’re ready depends on a range of factors, from your emotional availability (purchasing and owning a home is stressful!) to your financial stability.

How much house can I afford?

That depends. But most lenders use the 28% rule. This rule states that your home-related expenses should never exceed 28% of your gross (pre-tax) income.

Is my credit score high enough to buy a house?

Maybe. Though conventional lenders typically look for a 620 or higher, you can get approved for an FHA loan with a score as low as 500.

How do I know my credit score?

You can get a free copy of your credit report at AnnualCreditReport.com.

What’s the difference between pre-qualification and pre-approval?

During the pre-qualification process, your lender reviews your creditworthiness to provide a ballpark estimate of how much money you can borrow.

Comparatively, the pre-approval process is much more in-depth. And, at the end of it, you’ll receive more detailed insight into your potential loan terms.

How much money do I have to put down?

That depends on your lender, loan type, and creditworthiness. Some lenders – USDA, for instance – require 0% down. Others, like FHA, require at least 3.5% down.

Do I have to pay private mortgage insurance (PMI)?

Maybe. If you put less than 20% down, you’ll likely be expected to pay PMI.

What’s the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

With a fixed-rate mortgage, your interest rate stays the same during the lifetime of your loan. But with an adjustable-rate mortgage, your interest rate will change based on market conditions.

Which is right for you depends on your circumstances. If you want stable mortgage payments, a fixed-rate loan may be best. But if you hope to pay off your mortgage early or sell your home in the next three to five years, an adjustable-rate mortgage may be the best choice.

Do I need a real estate agent?

Yes. A real estate agent can help you find your dream home while also representing you during the negotiation process.

What should I look for in a real estate agent?

You need to find an agent you can trust who has experience finding homes in your desired area and price range.

Is there a difference between an inspection and an appraisal?

Yes. An inspection verifies the condition of the home while an appraisal verifies the value. You’ll likely need both when purchasing your first home. And you, as the buyer, will be expected to pay for both.

Do I pay my realtor?

No. The seller pays the real estate agent’s commission.

How long does it take to buy a house?

Longer than you think. Even after you find your dream home and your offer is accepted, it can take 30 to 60 days to close on the loan.